A national credit union hired me to collect 7,534 commercial loan contracts issued between 2007 and 2017. Here they are on a map.

Note: this data was sourced from public records. To learn more see how I built this.

Each parcel is color coded according to the size of the commercial loan taken against it; yellow for smaller loans, red for the largest. Also, the "reder" the loan, the taller it is. A scrolling panel on the right focuses on the 9 largest contracts in the county. Lets see what sticks out.

Cell tower companies have 4 of the 9 largest loans

SBA TOWERS V LLC

SBA MONARCH TOWERS III

SBA TOWERS IV LLC

AMERICAN TOWER DEPOSITOR SUB

The value of the land these contracts occupy is often far less than the individual loans; $45k versus $4.6B, so I suppose these large loans are more like umbrella contracts that companies can use to acquire property. The same appears to be at play for the other top 5 contracts... because it can't actually cost $2 billion to build a Hardees in Bartonville. So although there are $61 billion in commercial loans on record in Peoria between 2007 and 2017, the county has not actually seen that level of investment.

So how much commercial real estate investment has there actually been?

It's hard to say. Perhaps we can get closer to the truth by adding up the taxable values of all commercial properties in Peoria County. Since any given property may have been sold several times between 2007 and 2017, some appear more than once in this dataset - thus double counting its value. To make a distinction, we compute the aggregate duplicate and deduplicated taxable values across all commercial properties in Peoria. Those results are about $1 billion with duplicates and $454 million without duplicates.

Is that a more accurate answer? It's likely much closer to the truth than the $63 billion these loan contracts would have us believe. But as you will see in a minute, there is a wrinkle in this assessment.

Games are being played

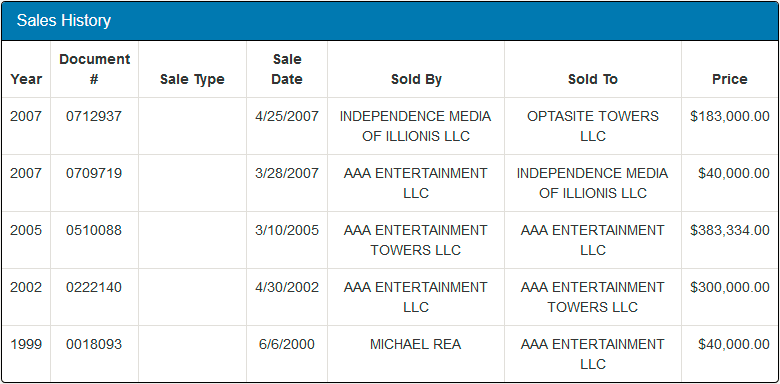

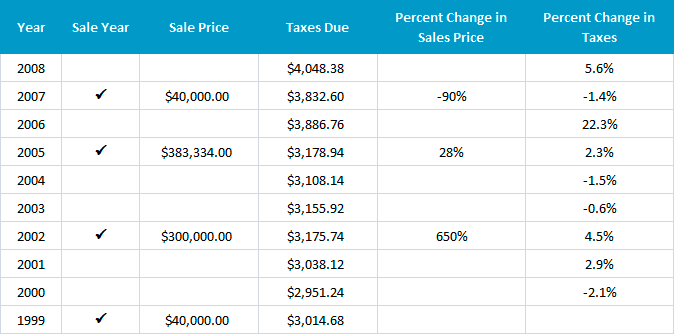

Let's focus on the tax record for 1803 S Trivoli RD (this is the third entry in the scrollable side panel).

AAA ENTERTAINMENT LLC bought this site in 1999 for $40k. Then in 2002 they flipped it to AAA ENTERTAINMENT TOWERS LLC for $300k... at a $260k "profit." Two years later they sold it back to themselves for $383k - this time at a $83k "profit." Then in the run up to the crash of 2008 they sold it to INDEPENDENCE MEDIA OF ILLIONIS LLC . This came at a $343k "loss" despite the fact that AAA ENTERTAINMENT et al. actually sold this parcel for the same price it cost them in 1999.

Meanwhile, the property taxes hardly changed and actually dropped immediately after both of the circular AAA ENTERTAINMENT purchases. For example, after 2002 when they sold it to themselves for 650% profit, this parcel's taxable value dropped about 2%.

What are we supposed to take away from this?

For me, it's pretty weird that a company can setup a bunch of versions of itself and engage in this level of self trading... even if it is a legal tax minimization strategy. Also, I was always under the impression that a property tax was supposed to mirror the value of its property so that if it were to rise in value (even artificially) its taxes should rise with it. But if that were true, then the taxes AAA ENTERTAINMENT paid in 2003, to a city that struggles to pay its pension obligations, should have been closer to $20k rather than only $3,155.

What do you think? Let me know in the comments. But before you do, here's one more chart I made showing the frequency of all loan filings in Peoria County.

What strikes me with this chart is that before I plotted it, I fully expected to see a rise in loan volume up to the 2008 financial collapse. Surprisingly, the big rise and fall happened four years earlier over the course of about 11 months. I've asked a number of bankers for their insight as to this drop long before the big collapse and none have been able to explain it.

Who hit the breaks on Peoria banks giving loans in January 2004? Was this a national occurrence? If so, why wasn't it enough to avert the crisis four years later?

If you know these answers then I'd love to hear your input down below. Feel free to also use the chat to politely challenge this article or, more excitingly, hire me to run your next data project.